Introduction

The AccountsIQ Mobile App is a handy productivity tool that's designed to automate:

- Employee expense claims capture.

- Purchase approval processes.

The Expense Claims Process

Employees create and submit expense claims via their mobile devices. When an expense claim is submitted via the app, a Purchase (Item) Invoice is created in your company and sent to the nominated approver.

The approver can then view full details of all expenses included in the claim along with any receipts attached by the employee. The approver can approve or reject the claim. Employees will be notified of any rejected claims via their mobile devices and will be able to amend the claim and re-submit for approval. Once approved, invoices can be posted, and payments processed just like any Purchase Invoice in the system.

Prerequisite

To use the app, your company must have a valid AccountsIQ subscription including the expenses app and workflow approval. Email support@accountsiq.com to add the app to your package or to find out more.

To use the features described in this article, ensure that the relevant user profiles have the following permissions:

- Employees

- Expense Items

- ERR Export

See:

Employee Expense Overview (21.0) - AIQ Academy (vimeo.com)

Employee Expense Overview (21.0) - AIQ Academy (vimeo.com)

Employee Expense Pre-requisites (21.1) - AIQ Academy (vimeo.com)

Employee Expense Pre-requisites (21.1) - AIQ Academy (vimeo.com)

Add Edit Employees - from existing suppliers (21.2) - AIQ Academy

Add Edit Employees - from existing suppliers (21.2) - AIQ Academy

Add Edit employees - creating new suppliers (21.3) - AIQ Academy

Add Edit employees - creating new suppliers (21.3) - AIQ Academy

Add Edit Expense Categories (21.4) - AIQ Academy

Add Edit Expense Categories (21.4) - AIQ Academy

Invite employees to mobile app (21.6) - AIQ Academy (vimeo.com)

Invite employees to mobile app (21.6) - AIQ Academy (vimeo.com)

Prerequisites - Legacy WFA only

Info: Our New Workflow Approval

If you have started to use the new WFA engine, this section will not be relevant as the new WFA is no longer limited to either Supplier or Budget based. See New Workflow Approval - New Look UI for more details.

Enable Approval Type

Both budget holder and supplier-based approval are compatible with the expense module.

- Go to Setup > Company Details &Settings.

- In the Approval Settings tab:

- Select Purchase Approval Enabled.

- For Approval Type, select Supplier or Budget Holder.

- Click Save.

Supplier-based Approvers

If you are adding individual records, check that all the relevant supplier accounts have a default approver before proceeding. For budget-based approval, the default approver is selected in the next step.

- Go to AP > Suppliers.

- Click Add/Remove Columns and select Default Approver and Email, then click Save. Check that all employees have a Default Approver and Email.

- If necessary, update the supplier record.

Using the New WFA with Expenses

If you are using the new workflow approval module, refer to New Workflow Approval for full steps on setup and processing documents through a workflow.

Steps to use the WFA and Expenses modules together

Perform the following in the given order:

- Enable approval for Purchase Invoices in the Approval Settings:

- Create the workflow approvers needed to approve expenses. See New Workflow Approval. These will appear for selection in the Employee record as outlined in this article.

- Create an employee record as described in this article.

- Create Workflows for Expenses, ensuring the following:

- Select the Non PO Invoice Process:

- In the Approval Step, select approval based on Employee. Employee will only be available as an option for the Non PO Invoice process.

- The Approvers you created in step 2 and the Employees you created in step 3 will be available for selection:

- Select the Non PO Invoice Process:

Add New Employees Individually

If you have employees set up as suppliers, you have two options:

- Add individual employee records linked to the relevant supplier account. This option can also be used to edit records.

- Use a bulk import facility to create employee records from your existing suppliers. Alternatively, both suppliers and employees can be created simultaneously. This is described in the next section.

Manually Create New Employees

- Go to Setup > Employee > New Employee.

- In the Supplier dropdown, select the employee that was set up as a supplier. Note, that employee email addresses cannot be edited. If you need to change the email address of an employee, contact the support team at support@accountsiq.com.

- Select a Workflow Approver:

- If you are using the new WFA module, the approvers you have already set up will be available for selection. See New Workflow Approval for more details. Later when you create approval workflows for employee expenses, the Approver dropdown will be filtered to show approvers linked in employee records. In turn, the Employee dropdown will only show employees linked to that approver.

- If you use the legacy budget-holder approval, you will now be able to select an approver.

- For legacy supplier-based approval, the approvers assigned in the Supplier Record will appear here. To change it, you must edit the original Supplier Record.

- If you are using the new WFA module, the approvers you have already set up will be available for selection. See New Workflow Approval for more details. Later when you create approval workflows for employee expenses, the Approver dropdown will be filtered to show approvers linked in employee records. In turn, the Employee dropdown will only show employees linked to that approver.

- In the BI Coding Defaults dropdowns, you can decide which BI Codes are available when the employee makes an expense claim via the app. If you select Dimension Elements here, the employee will only be able to select from the associated BI Codes. If you do not make any selection, the employee will see all BI codes.

- Next in the Expenses Categories tab, select categories that should not be selected on the app.

- For full details on completing the final tab, see Setting Up Mileage Expenses.

- Click Process.

Import Employees in Bulk

The Import Employee template lets you import employees in bulk. It has two worksheets:

- New Supplier and New Employee

- New Employee from Supplier

New Supplier and New Employee

- Go to Setup > Employees > Import Employees.

- Download the Excel template.

- Fill out all mandatory fields in the New Supplier & New Employee tab:

- Supplier Code: You can create a different coding convention to easily identify employees from trade suppliers.

- Name: Enter the employee’s name.

- Email address: Enter the employee's email address. The email address must be unique for each employee, and an employee can only be set up in one company. This is the address that the mobile app invitation will be sent to. The employee will need to be able to access this email account from their mobile device to successfully set up the app.

- Expense Claim Approver email: Enter the email address of the approver. They must be set up as an approver before importing the data.

- GL Account: Enter the default GL Code for supplier invoices.

- Control GL Code: Enter the creditor's control account.

- All other fields are optional, but we recommend using the following if needed:

- Paid from Bank Account: Enter the bank account that expenses will normally be paid from.

- Payment Method: Enter the payment method description. This is useful if you want to use batch payments.

- Credit Terms: Enter the credit term description (not the code).

- Bank A/C Number, IBAN, Sort Code, BIC/Swift Code: These are particularly important if you want to use batch payments.

- If needed fill out the Initial Employee Mileage worksheet. This brings forward mileage balances for new employees coming from other companies.

- Upload the completed file and click Import on the same screen. You can choose whether to send the expense app invites to new employees at this point. If you are not ready to do this yet, select No and you can email the invites from the Employee tab when you are ready.

- If there are any errors in the import sheet, you will see a validation error and you will be able to download the template showing details of any errors. You should correct these and then re-import the sheet.

New Employee from Supplier

- Go to Setup > Employees > Import Employees.

- Download the Excel template.

- Fill out the New Employee from Supplier tab in the template, adding the supplier codes that you want to create employees for, and optional Vehicle and Licence Plate.

- If relevant, fill out the Initial Employee Mileage worksheet. This brings forward mileage balances for new employees coming from other companies.

- Upload the completed file and click Import. When you import, you can choose whether to send expense app invites to new employees. If you are not ready to do this, select No and you can email the invites from the Employee tab when you are ready.

- If there are any errors in the import sheet, you will see a validation error and you will be able to download the template showing details of any errors. You should correct these and then re-import the sheet.

Add Expense Categories

Expense categories should be set up for each item you want employees to record their expenses against, for example, travel, and hotel accommodation. To set up mileage as an expense category, see Setting Up Mileage Expenses.

You can set up as many categories as needed. Each category has a default tax and GL code. If you want to post expenses to different tax or GL codes, you should set up a category for each expense.

Creating a New Expense Category

- Go to Setup > Expense Items > New Expense Item.

- Complete the following:

-

Code: Record a unique identifier code for this expense category. Codes must not include spaces or special characters. Note that this code will not be displayed in the mobile app where employees capture their expenses. For ease-of-use employees will instead pick expense categories using a drop down displaying the expense category's description. The expense category code will be shown on the Purchase Item Invoices generated from submitted Expense Claims within the core system.

- Description: Enter a description for the expense category. Like the code, this is visible to the employee so should be meaningful to them.

- Tax Code: Set the tax code and rate that's applicable to this expense category. The employee will not be able to see or amend this. This will determine if tax should be added to the item when it is captured on expense claims entered via the mobile app. Employees should enter the gross amount for each expense and the system will calculate the VAT at the default rate. This can be amended by the finance office on the Purchase Invoice before posting or adjusted via a journal. It is possible to change the tax code on a captured expense claim (i.e. Purchase Invoice) before it is posted.

- GL Account Code: This is the default GL code that each expense will be recorded against. We recommend using at least one expense category for each GL code that you would like expenses recorded against.

- Requires Quantity: Set this flag if the employee needs to supply a quantity (i.e. units) that should apply to this expense category, for example, if an employee chooses a particular expense category that is reimbursed by your company based on the number of units or quantity consumed and a reimbursement rate (e.g. fuel expenses per mile or kilometre). Setting this flag will display a Quantity field on the app, which will otherwise be hidden if the flag is not set.

- Active: Use this flag to mark this expense category as active or inactive. Inactive expense categories will not be displayed for selection by employees within the expenses mobile app.

- Description: Record a description associated with this expense category. This description will be shown to users of the mobile app when they are recording expense receipts and within Purchase Item Invoices generated from submitted Expense Claims. Make this description clear and easy to understand.

- GL Account Code: This is the default P&L Expense GL Code that this expense category should be coded to on Purchase Invoices generated from Expense Claims. The GL code will not be shown to users of the expense app, instead it will be set automatically depending on what's stored here and added to the lines on a Purchase Invoice generated from the Expense claim. The GL code can be changed on a Processed (Approved or Unapproved) but not Posted Purchase Invoice.

- Reimbursement Rate: Record the unit rate (net of tax) at which an employee will be reimbursed for this expense category (e.g. rate of reimbursement for fuel per mile/km). The total amount reimbursed to the employee will be this rate multiplied by the quantity of units incurred as recorded via the mobile app, plus any tax if applicable. This can only be set when the required quantity is selected. We recommend adding details of the rate to the Description.

- Tax Reporting? (Ireland only): This is used for enhanced Revenue reporting. Check to include the expense categories in the report.

- Category Group and Category Sub Group (Ireland only): Select an option for each to include them in the Revenue report.

-

Code: Record a unique identifier code for this expense category. Codes must not include spaces or special characters. Note that this code will not be displayed in the mobile app where employees capture their expenses. For ease-of-use employees will instead pick expense categories using a drop down displaying the expense category's description. The expense category code will be shown on the Purchase Item Invoices generated from submitted Expense Claims within the core system.

- Click Process to save the Expense Category.

Info

For more on updates to Revenue reporting, see Enhanced reporting requirements from 01 January 2024 (revenue.ie).

Tax Reporting?, Category Group, and Category Sub Group will not show for the Mileage Expense module. Instead, all mileage expenses will automatically be tagged Travel Subsistence > Travel Unvouched.

Editing Expense Items

- Go to Setup > Expense Items.

- Click on the Expense Item ID and update as required.

- Click Process.

Deleting Expense Items

If you need to delete expense categories, email the details to support@accountsiq.com

Invite Employees to the Mobile App

Sending an App Invite

Sending an invite to employees lets them securely link the app on their mobile device to your company without the need to set up usernames or passwords. You can send invites to employees in bulk if you import your employees (see Add/Edit Employee sections). Otherwise, or if an employee needs another invite, you can send invites from the system if you have an Admin user role.

- Go to Setup > Employees.

- Next to each employee's name, go to Actions > Send mobile expenses app invite.

Accepting an App Invite

The employee should then:

- Download the AccountsIQ mobile app.

- Click the Getting Started link in the email to link the app to the company they will be submitting expenses to.

- Allow the app to access notifications, camera, and photos.

Using the Mobile App to Make Expense Claims

Using the Mobile App to Make Expense Claims

Viewing App Status

Go to Employee Expenses > Employees to view the following two status columns.

Access Status column

- Enabled: The employee invitation has been sent. Go to Actions > Disable Access to Mobile Approval App if you no longer want the employee to be able to access the app.

- Disabled: The employee invitation has not been sent. Go to Actions > Send Mobile Expenses App Invite to enable access.

Is Mobile Invite Accepted column

- No: The employee's app is not connected to the database, and they will not be able to submit expense claims.

- Yes - Expenses Only: The employee has installed and connected the Expenses app successfully.

- Yes - Approval and Expenses: The employee has installed and connected the app and can use it for expenses and approval.

Employee Expense Report (Ireland Only)

The report "Employee Payments" is available in the Report Manager under Purchase Reports. Note that expense claims will only appear in the report when they are marked as paid/allocated to the payment.

It is automatically available for all users with the system administrator profile and can be added to the permissions for any other user via Maintain Menu Profiles.

Info

The Employee Expense Report is available as an aid for submitting your returns. For any queries regarding the appropriate submission format, please contact Revenue.

See:

FAQs and Troubleshooting

Why can't I see the Employee Expenses or Approver Setup tab(s)?

You must have a valid subscription to use both employee expenses and workflow approval. If you have a subscription and cannot see the tabs, ask your local admin user to check that you have the correct permissions enabled in your profile.

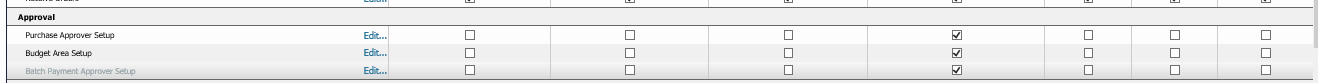

You can check this at the group layer. Go to Actions > Maintain Menu Profiles next to the required company ID.

- To access the Approver Setup tab, Purchase Approver Setup should be ticked.

- To access the Employee Expenses > Employees, Employees should be ticked.

- To access the Employee Expenses > Expense Categories, Expense Items should be ticked.

Remember, if you enable a feature in the Menu Profiles, all users assigned to that profile will have access to the feature.

To control which users have access to particular features, you can create new profiles.

How can employees submit expense claims in different currencies?

The expense app only supports expense claims in a single currency per employee. Check the currency code by going to Purchases > Suppliers and clicking on the employee.

The app does not support multiple currency claims.

Can employees submit claims to more than one company?

The expense app only supports expense claims being sent to one company.

How can I delete an expense category?

There is no way to delete an expense category currently. If you need categories deleted, email the details to support@accountsiq.com and we can do that on your behalf.

How can employees use the app for credit card expenses?

The app has been designed to work with reimbursable expense claims. When a claim is submitted, a Purchase Invoice will be created with no automatic payment or allocation.

If an employee wants to use the app to record only credit card claims, you can set the payment terms against the supplier to "credit card". You must create a local process to ensure that these invoices are not paid to the employee - the expense claim will create an unpaid purchase invoice, and the system will not automatically exclude these invoices from payment runs.

It is not recommended to use the app for a combination of credit card and reimbursable expense claims.

My employee has not received the invitation email.

Ask the employee to check their junk folders. If the email is not there, send a new one by going to Employee Expenses > Employees, followed by Actions > Send Mobile Expenses App Invite next to the employee's name.

My employee can't connect to the app.

Most connectivity problems arise if more than one invitation is sent to an employee. In this case, they must use the most recent email sent.

If an employee is having trouble connecting to the app:

- Ask the employee to delete all invitation emails and the app from their mobile device.

- When the employee has deleted the app and the emails, send a new invitation email from Employee Expenses > Actions > Send Mobile Expense App Invite.

- Ask the employee to download the app and then click on Getting Started in the invitation email.

If they are still having difficulties, please email the following information to support@accountsiq.com:

- Which Operating system is being used - Android or IOS?

- Which App version is being used?

- Are all users affected?

- User Id and e-mail of affected User(s)?

- What are the company ID expenses being raised against?

- Has the user ever connected the app to another company?

How does the app work if I use it for both expenses and purchase approval?

There is one mobile app that will allow users to manage their expenses and/or purchase approvals depending on the level of access the local administrator has set up.

- Check by going to either:

- Go to Approver Setup > Purchase Approvers.

- Go to Employee Expenses > Employees.

- Check Is Mobile Invite Accepted:

- No: The employee's/approver's app is not connected to the database and they will not be able to submit expense claims.

- Yes - Expenses Only: The employee/approver has installed and connected the Expenses app successfully.

- Yes - Approval Only: The employee/approver has installed and connected the approval app but will not have access to expenses.

- Yes - Approval and Expenses: The employee/approver has installed and connected the app and can use it for expenses and approval.

- You can update access rights by clicking Actions next to the employee or approver.