Introduction

General Ledger Structure

The system comes with a standard package of General Ledger Accounts and Codes. These include:

- General Ledger Categories.

- General Ledger Sub-Categories.

- General Ledger Groups.

- A set of other Codes, including Currencies and Taxes.

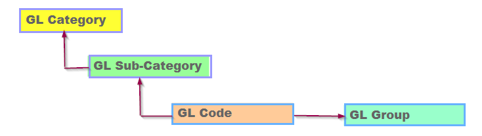

General Ledger Codes belong to General Ledger Sub-Categories which in turn belong to General Ledger Categories:

GL Structure and Business Requirements

Our pre-defined Codes will help you to start very quickly. Review them to determine if they reflect your requirements. Codes can be re-defined and deleted or discarded in favour of your own existing Coding System.

As you progress, it may be necessary to add Codes, especially as you require more in-depth Analysis and Reporting. To do do, you must fully understand the role of the General Ledger Categories and Sub-Categories in driving the design and layout of the Profit & Loss and Balance Sheet Reports.

Importing GL Accounts

This article details creating individual GL accounts manually. If you have multiple accounts to set up, you can create them in bulk using the Chart of Accounts Data Importer.

See:

Creating GL Categories, Sub-Categories, and Groups

Before you add more General Ledger Codes, you may want to review, amend, or create additional General Ledger Categories and/or Sub-Categories as you will need these when adding new General Ledger Codes.

General Ledger Categories

There are eleven pre-existing GL Categories, numbered 1 to 11 as Alphabetic Codes, which you cannot edit or delete. You can, however, edit them, change their meaning, and add more.

- Go to Setup > Codes Maintenance > GL Categories.

- Click Add New Category.

- In the Category Type dropdown, select an appropriate category. Category Type is inherited by its descendants: Sub-Categories, and GL Codes. Category Type determines what reports, or sections of a report, the General Ledger Codes that belong to it will appear.

- Enter a Description.

- Click Save. If you need to make any updates, click Edit. All fields except Code and Created by can be edited. Delete will be available only if the code has no associated transactions.

When you create a GL Category, a P&L Sort Order number is assigned in ascending order starting with 1. This determines its position on reports. If you want to change the sort order:

- Click on Edit next to the relevant entry.

- In the P&L Balance Sheet Sort Order field, change the GL Category’s position by editing its Sort Order Code. Alternatively, add a new GL Category with a new Sort Order Code.

- When you tick Re-sort sort order, the sequence will be re-ordered.

- Click Save.

GL Sub-Categories

The system comes equipped with a standard set of General Ledger Sub-Categories which you can add to or modify. Each also has a Profit & Loss (Income & Expenditure) Sort Order Code which determines the sequence of their appearance within a General Ledger Category.

- Go to Setup > Codes Maintenance > GL Sub-Categories.

- Click Add New GL Sub-Category.

- Add a Code and Description.

- If you tick Non-Cash Item in a Cashflow Report, all General Ledger Codes that have that General Ledger Sub-Category as a parent will be excluded from Cash Forecasting.

- Click Save. If you need to make any updates, click Edit. All fields except Code and Created by can be edited. Delete will be available only if the code has no associated transactions.

When you create a GL Sub-Category, a P&L/BS Sort Order number is assigned in ascending order starting with 1. This determines its position with the relevant GL Category on reports. If you want to change the sort order:

- Click on Edit next to the relevant entry.

- In the P&L/Balance Sheet Sort Order field, like GL Categories you can re-sequence the Report or Chart of Accounts.

- When you tick Re-sort sort order, the sequence will be re-ordered.

- Click Save.

Using General Ledger Groups

General Ledger Groups are optional and do not feature in the hierarchy of the General Ledger Coding Structure. They allow for the grouping of accounts in:

- standard reports (Trial Balance by Transaction Details - Period Date, and Trial Balance by BI Code)

- custom reports

- OData reporting

- GL listing grid under the GL Group column.

Examples of groups could include:

- P & L Accounts: You could group all Income into Recurring Revenue or Non-recurring Revenue.

- Costs: You could group all Insurance costs, Legal Costs, Employee Costs, or Facility Costs.

-

Balance Sheet Accounts: You could group Prepayments, Deferred Revenue Accounts, Revenue Accruals, Cost Accruals, Banks, or Tax.

To create GL Groups:

- Go to Setup > Codes Maintenance > GL Groups.

- Click Add New Group.

- Add a Code and Description.

- Click Save.

See:

Creating General Ledger Accounts

Adding to existing GL Codes

There are several ways you can extend the pre-defined set of General Ledger Codes.

- Add New Codes in the gaps between the existing ones. For example, if you have codes 1010 and 1020, add 1012, 1014, 1016, and 1018.

- Use suffixes to expand an existing Code, for example, 3500-10.

- Set up completely New Codes, for example, ROOFING.

Creating a GL Account

- Go to GL > General Ledger Accounts > New GL Account to add a new GL Code.

- In the General Ledger Maintenance screen, complete the following where relevant:

-

GL Acc No: Enter a new General Ledger Account Code.

- GL Acc Name: Enter a Description for the Code.

- Parent: Optional. You can choose a GL Code from the dropdown. Some traditional Chart of Accounts attach GL Codes to a Parent. This is not used in the normal operation of this system but can be used in bespoke reports.

- Notes: Optional. Enter any information relevant to the Account such as its usage.

- Ref GL Acc No: Optional. It is normally used to reference a previous Chart of Accounts Code. Not used in the normal operation of this system.

-

Category: This is the GL Category to which this GL Code belongs. The Category Type is automatically inherited from this Category and allocated automatically to this GL Code. To add new General Ledger Categories and General Ledger Sub-Categories, click +Add new GL Category.

- Sub-Category: This is the GL Sub-Category to which this Code belongs.

- VAT: Enter the VAT Code for this GL Code in the absence of a VAT code from another source such as Product or Customer/Supplier.

- Group: You can group GL Codes together by assigning them a common Group Code. For example, you could assign a common Group Code to different Insurance cost codes.

- Use BI Code: Tick this to enforce the use of Analysis Codes during Transaction entry.

-

GL Acc No: Enter a new General Ledger Account Code.

- Click Process to add the new GL Account Code to the table of General Ledger Codes.

Managing GL Accounts

Click an existing GL Code if you want to edit it. The listing grid also lets you view or edit GL transactions, attach or view GL related documents, and view or maintain GL Budgets (see Managing General Ledger and Analysis Budgets).

Deleting unneeded GL Codes

GL Codes that fit your needs

The supplied standard GL Code Package is fully comprehensive, catering to the needs of diverse types of businesses. However, we recommend deleting any surplus to your requirements. This allows for more streamlined dropdown menus and avoids unnecessary complication, such as unused GL Codes in GL Budget documents.

Deleting GL Codes

Only GL Codes with no associated transactions can be deleted.

- Go to GL > General Ledger Accounts and find the relevant account.

- Click Delete. Remember, if you are overly zealous in removing GL Codes, you can always add them back in later.

GL Accounts with Transactions

If there are transactions against the GL Code, Delete will not be available. Therefore, it is particularly important that you remove any unnecessary GL Codes before letting users add transactions.

In case you want to discontinue using a GL account, we recommend adding the term ‘Do Not Use’ in the name of the account.

Re-Defining GL Codes

- Go to GL > General Ledger Accounts and find the relevant account.

- In the General Ledger Maintenance screen, change the meaning of your existing GL Codes by editing the GL Account Name and the GL Category and GL Sub-Category they belong to. Note that changing the category type assigned to the GL Account will affect its classification.

- Click Process.

Creating General Ledger Control Type C Accounts

Control vs System Accounts

Control Accounts are GL Accounts that the system will only use during automatic system transaction posting. Control accounts include:

- Debtors Control

- Creditors Control

- Sales/Purchase Tax Control

- Retained Reserves

In contrast, you can create manual postings to System Account in addition to automatic system transactions. System accounts include:

- Discounts

- Accruals

- Prepayments

- Currency Gain/Loss Account

Create a General Ledger Control Account

- Create a regular GL Account as outlined earlier.

- Go to Setup > Codes Maintenance > System Accounts.

- Click Add New Control Accounts.

- In Account Type, select the relevant type.

- In Linked GL Account, select the account you created earlier.

- Click Save.

Updating Control Account Type

Accounts that have been converted into system or control accounts cannot be changed. If the account type needs to be changed, we recommend deleting the account (as long as it has not been used in transaction processing) and creating a new one with the correct type.