Introduction

GL Code structure and reporting

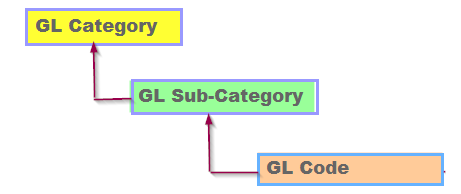

The layout and completeness of your reports, such as Income and Expenditure Statements, Trial Balance, and Balance Sheet depend on how the General Ledger Coding is structured. In the coding structure, each General Ledger Code is attached to a higher-level Sub-Category which in turn is attached to a higher-level General Ledger Category.

The General Ledger coding structure affects the layout of a report as follows:

- General Ledger Categories become the main row headings, such as Income, Revenue, Direct Costs, Overhead Costs, and Expenses, while columns are user-defined during report creation.

- General Ledger Sub-Categories become the sub-headings within each category, such as “Home Sales”, “Exports”, and “Spares” within the “Income” Category and, “Rent & Rates”, “Computer Costs”, Finance Costs” within the “Overhead Costs” Category.

- General Ledger Codes become the lowest level of analysis on reports. It is not possible to accidentally leave out a General Ledger Code from any of the reports. GL Codes are automatically included in the reports by virtue of their Category and Sub-Category.

Designing a GL Coding System

Info

- Before proceeding, read Managing General Ledger Accounts and use it in conjunction with this article.

- Control Account Codes, maintained in Setup > Codes Maintenance > System Accounts, cannot be deleted.

Use the default GL Codes or design your own. If you use the default coding, we recommend removing unnecessary codes and adding only those your business requires for a better user experience. If necessary, you can add codes back at any time.

Ensure GL Categories and Sub-Categories fit your reporting needs as follows. See Using Codes Maintenance for full details:

- Add or delete Categories and Sub-Categories.

- Edit Descriptions as needed.

- Update Category Type as needed. Sub-Categories and GL Codes inherit their Type from the associated Category. Note that some reports will only work with certain Category Types. For example, the P & L Reports work with Revenue and Expense General Ledger Codes, and the Balance Sheet reports on Assets, Liabilities, and Equity type General Ledger Codes.

- Edit reporting Sort Order (see next section).

See:

Using Extended Business Analysis

Using Extended Business Analysis

Using Extended Business Analysis for Job or Project Analysis

Using Extended Business Analysis for Job or Project Analysis

Updating Report Layout

Report Sort Order

The report layout is as follows:

- General Ledger Category: In ascending Sort Order, starting with 1.

- General Ledger Sub-Category: In ascending order, using the Sort Order assigned to that Sub-Category.

- General Ledger Code: In ascending order.

For example, if the Category “Operating Income” has a Profit & Loss Sort Order of 1, it will appear as the first line of the Profit & Loss Report, with all its Sub-Categories an appearing in sequence beneath it.

Step One: Set Category Sort Order

Go to Setup > Codes Maintenance > GL Categories and add or edit a Category.

Ensure the P&L Sort Order fits your needs and tick Re-sort sort order to re-sequence any changes. Click Save. See Using Codes Maintenance for more details.

Here is the sort order:

Step Two: Set Sub-Category Sort Order

Repeat as step one but for Sub-Categories:

Step Three: Assign GL Codes to Categories and Sub-Categories

Go to GL > General Ledger Accounts and open the relevant GL Codes.

Assign the correct GL Code in the Category and Sub-Category dropdowns. Click Process. See Managing General Ledger Accounts for more details.

Step Four: Review your Report Layout

When you have finished configuring the Categories, Sub-Categories and GL Codes, go to Reports > Report Manager > GL Reports > Chart of Accounts Layout.

Click View and check that everything is as required. For more details on reporting, see Using the Report Manager.

Example: P&L Vs Budget Summary Report

Summary Reports only report on Category and Sub-Category total while Detailed Reports include GL Codes within the Sub-Categories.

Go to Reports > Report Manager > GL Reports > Profit and Loss Vs Budget Summary.

In Profit & Loss Reports, you can include auto-calculated Contribution and Gross Profit lines.

- Contribution is Sales Revenues less Direct Costs. It is the amount available to cover Indirect Costs.

- Gross Profit is Sales Revenues less the Cost of Goods Sold.

Select Yes in the Show Contribution dropdown. Click View.

The Report uses the General Ledger Category and Sub-Category sequencing that you set up: