Introduction

MTD Regulations

UK VAT-registered businesses with accounting periods starting on or after 1 April 2019 are required to keep digital records for all VAT transactions and use software to submit VAT returns to HMRC digitally. This is also known as Making Tax Digital or MTD.

We are listed by HMRC as compatible software for the submission of VAT returns and facilitate VAT Returns at no extra cost.

Check the HMRC website to see if you have to join Making Tax Digital for VAT and if you will be eligible for deferral or exemption.

Signing up for MTD

Before you can submit your first VAT return online, you need to sign up for Making Tax Digital for VAT with HMRC at least one week before your VAT Return is due.

Info

Even if you are currently registered with HMRC to submit VAT returns, you will still need to sign up for Making Tax Digital for VAT to be able to submit your VAT returns digitally through AccountsIQ or any other compatible accounting software package.

Full details of how to sign up with HMRC can be found on the HMRC website.

Sign up for Making Tax Digital for VAT via the HMRC portal. You must be the Administrator or Agent registered to submit VAT returns for the company.

You will need:

- your existing Government Gateway user ID and Password.

- additional information, such as Company ID and number, and type of business.

Once you have received the email from HMRC confirming that you are signed up for MTD for VAT, you need to connect the system to HMRC for VAT to complete the process.

Connecting to HMRC

MTD Nominated Administrator

The user who signed up for MTD with HMRC must make the connection between the system and HMRC. No other user can make a valid connection to create or submit a return. If they attempt to do so they will receive an error message.

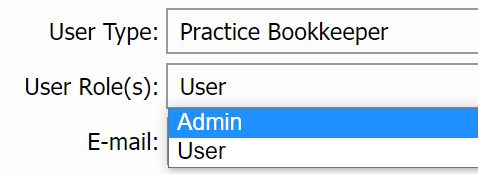

In addition, they must have an Admin User Role. See Setting Up System Users for more details.

Within the system follow these steps to connect your company to HMRC to submit VAT Returns (also known as authorising your software):

Step One: Check that there are no outstanding VAT returns

Ensure that all previously created VAT returns are closed.

- To check, go to GL > VAT Management.

- If there are any returns in the VAT Return Listing without a status of Returned, return these before making the connection to HMRC. If any VAT returns were created in error, unselect all transactions from the return, save, and return.

Step Two: Check Company Details are correct

- Go to Setup > Company Details & Settings.

- Under the Company Details tab, check that the VAT Registration Number is correct.

- Under the Integration tab, under HMRC On-Line VAT Returns, click Connect.

- When the Government tax service Gateway loads, click Continue > Sign in to the HMRC online service.

- Enter your credentials and click Sign In.

- The details entered will be validated and confirmed by HMRC. If successful, a confirmation message will appear, indicating that your company is now connected.

Warning

Note that the connection established between HMRC and the system (the integration token generated) is valid for 18 months from establishing the connection as per HMRC's security policy. After 18 months you will need to re-establish the connection to HMRC using the steps above.

Step Three: Submit the VAT Return to HMRC

Follow the instructions outlined in How do I Produce my VAT Returns (U.K. & Ireland)? as pertaining to the UK.