Setting up Reverse Charge Tax Codes on Irish Format VAT Returns

To set up a reverse charge VAT code:

- Go to Setup > Codes Maintenance > Tax Codes.

- Add a Tax Code or edit an existing code in the list.

- Tick EU Trade and Reverse Charges.

- Select Goods or Services.

- Click Save. Reverse charges will be calculated at the standard rate for the company.

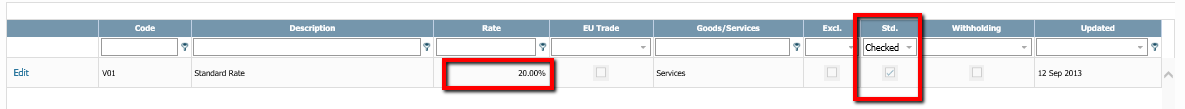

To check the company standard rate:

- Go to Setup > Codes Maintenance > Tax Codes.

- In the Std column, set the filter to Checked. In the example below this is set to 20%:

See:

Understanding EU Reverse Charges on the Irish VAT Return

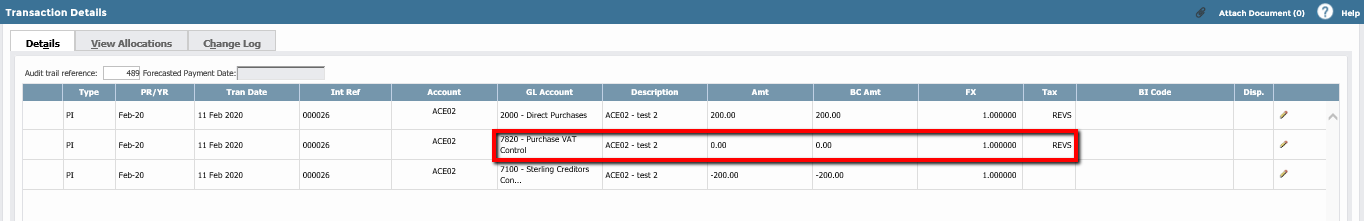

This VAT Return contains a single Purchase Invoice of £200. It carries a VAT Code tagged as EU Trade and Services with a rate of 0%, while the company has a standard VAT rate of 20%.

The value of the VAT on the Purchase Invoice is 0.00.

VAT on Sales [T1]

The system adds the value of VAT on EU Purchases calculated above, in this case, £40 in VAT on Sales [T1].

VAT on Purchases [T2]

The system calculates the VAT due on EU Purchases of Goods and Services at the standard rate for the company. In this case, 20% of £200 is £40.

This is added to the total in VAT on Vat on Purchases & Other Inputs [T2] of the Irish VAT Return.

Net VAT for payment/reclaim [T3] [T4]

The total VAT Payable or Repayable is calculated and shown in boxes T3 and T4. In this example, where there is only a Reverse Charge Invoice, the net VAT will be zero as the value of sales is the same as purchases for Reverse Charges.

Total Services from other EU countries [ES2]

The gross amount of any Purchase Invoices carrying the Reverse Charge VAT Code Service is entered into Total Services from other EU countries [ES2]. In this case, it is £200.

Total Goods from other EU countries [E2]

The gross amount of any purchase invoices coded to the Reverse Charge VAT Code Goods is entered into Total Goods from other EU countries [ES2]. In this case, it is £200.