1. Introduction:

The system is multi-currency. Transactions entered in a Foreign currency throughout the month attract the exchange rate on the day and calculates a base currency equivalent along with the foreign currency amount, both of which are held with each transaction. When Invoices are settled (or partially settled), the Rate of Exchange of the Payment or Receipt (or Credit Note) is compared to the original Rate of Exchange of the Invoice and a Currency Gain or Loss is worked out and posted to the General Ledger - thus effectively completing the transaction pair. However, fom time to time, (usually towards the end of a Financial Period), you may wish to re-value the Open Items (i.e. the Un-settled Invoices, Credit Notes, Payment or Receipts on Account, etc.) in your Ledgers to reflect the current exchange Rates rather than the historical daily exchange rates being carried with the foreign currency invoice transactions. The system facilitates this by comparing each open transaction's exchange rate with those current at the time of the revaluation, works out the Gain or Loss and posts the results through the use of Auto-Reversing Journals. The Reversing is automatic, and if the transaction remains open when a subsequent revaluation takes place, will undergo the same process once again.

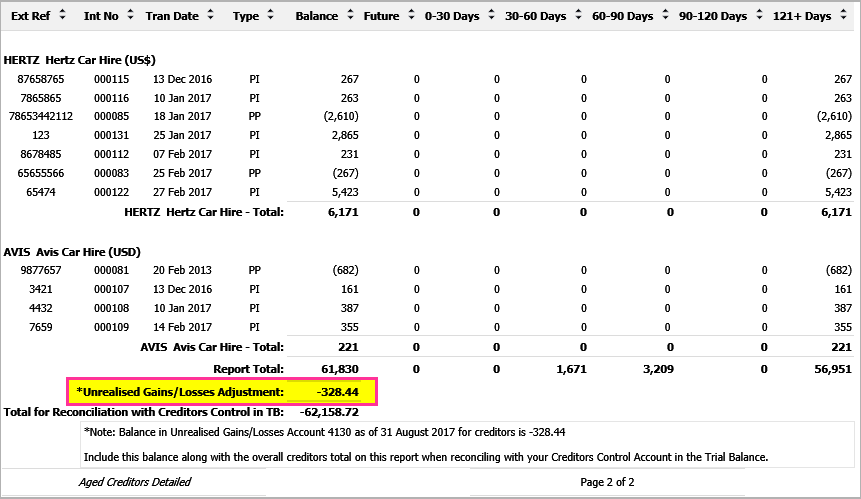

The amount of these revaluations is also included in the Aged Debtors or Creditors report to facilitate reconciliation with the relevant General Ledger Control Account.

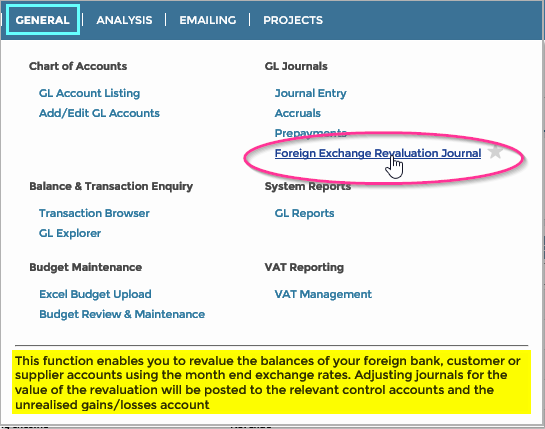

When this function is required go to General > GL Journals > Foreign Exchange Revaluation Journal;

2. Foreign Currency Revaluation:

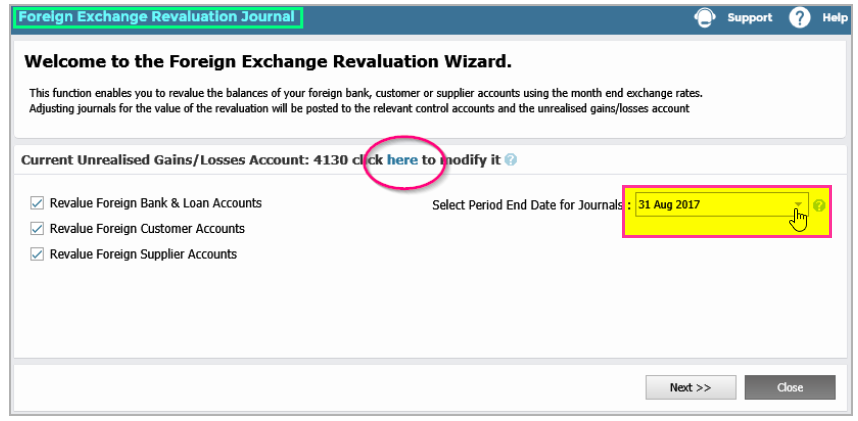

You are now presented with this screen;

In this example, we have chosen to re-value the Customers Debtors Ledger (AR), the Suppliers (Vendors) Creditors Ledger (AP) and all Bank & Credit Cards. You also need to select the next period end date. Both Exchange Gain/Losses Journals and Journal reversals will be generated at the same time. The generated Journals will carry this Period End Date and the generated Journal Reversals will carry the first date of the next Period.

In this example, we have chosen to re-value the Customers Debtors Ledger (AR), the Suppliers (Vendors) Creditors Ledger (AP) and all Bank & Credit Cards. You also need to select the next period end date. Both Exchange Gain/Losses Journals and Journal reversals will be generated at the same time. The generated Journals will carry this Period End Date and the generated Journal Reversals will carry the first date of the next Period.

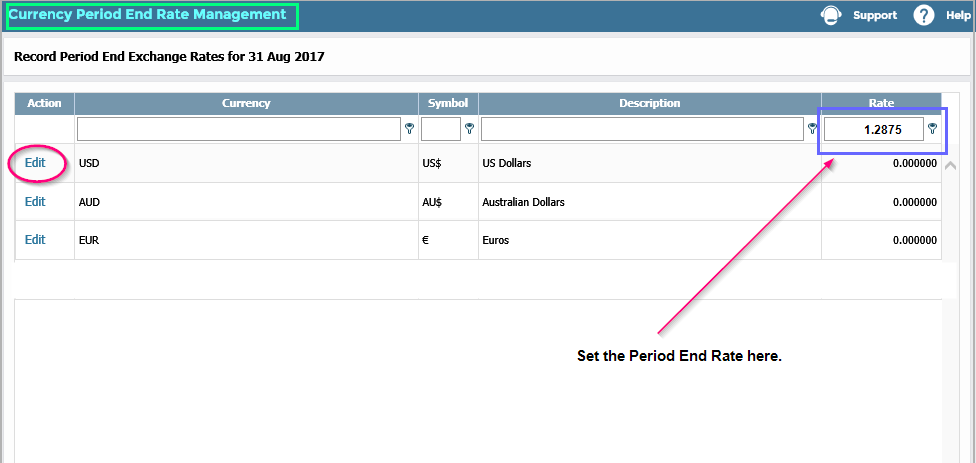

Next, you need to enter the appropriate Exchange Rates against your Base Currency for each Currency in your System;

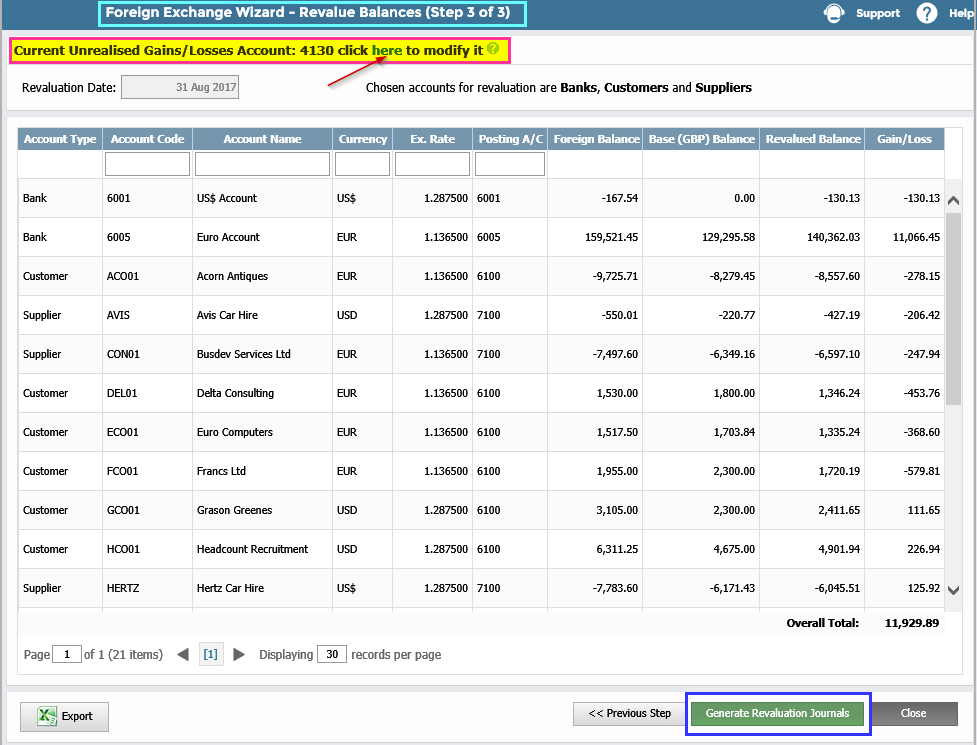

Click on the Edit function next to each currency in turn, and then enter the new Rate of Exchange, followed by "Update". The Historical Rates of Exchange carried on each transaction will remain untouched. Instead, the new Rates of Exchange will be compared to the Historical Rates of Exchange in order to calculate the Unrealised Gains or Losses Journals and their cancelling Reversals. On choosing "Next Step" at the bottom of the foregoing screen, the system will present a report of the generated Gains or Losses for each Customer, Bank or Supplier (Vendor) for your appraisal. To actually generate and post the Accruals and Reversals you must now click on the "Generate Revaluation Journals" button at the bottom of the screen;

3. Revaluation Journals and Reversals:

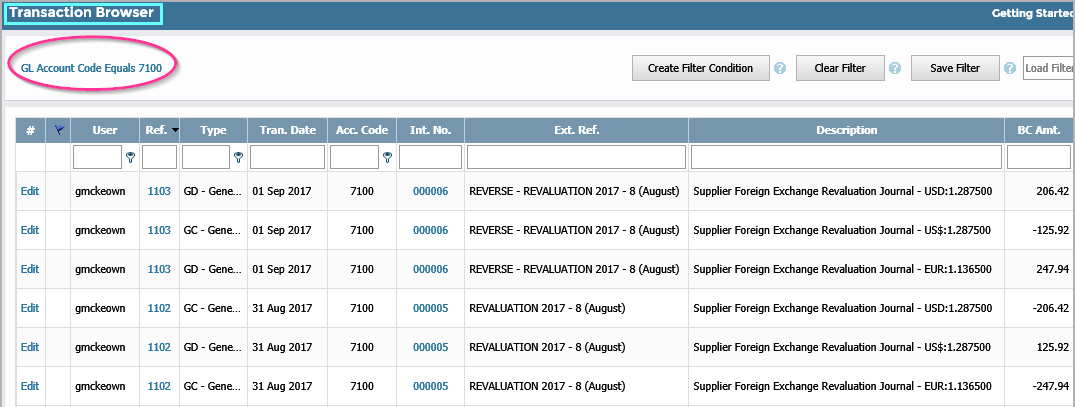

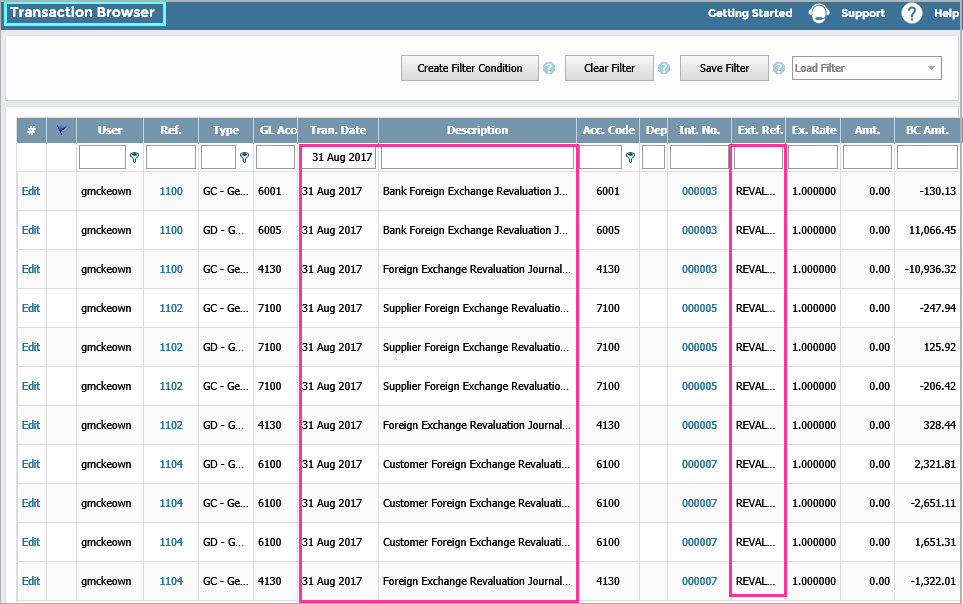

Here are the Posted Revaluation Journals;

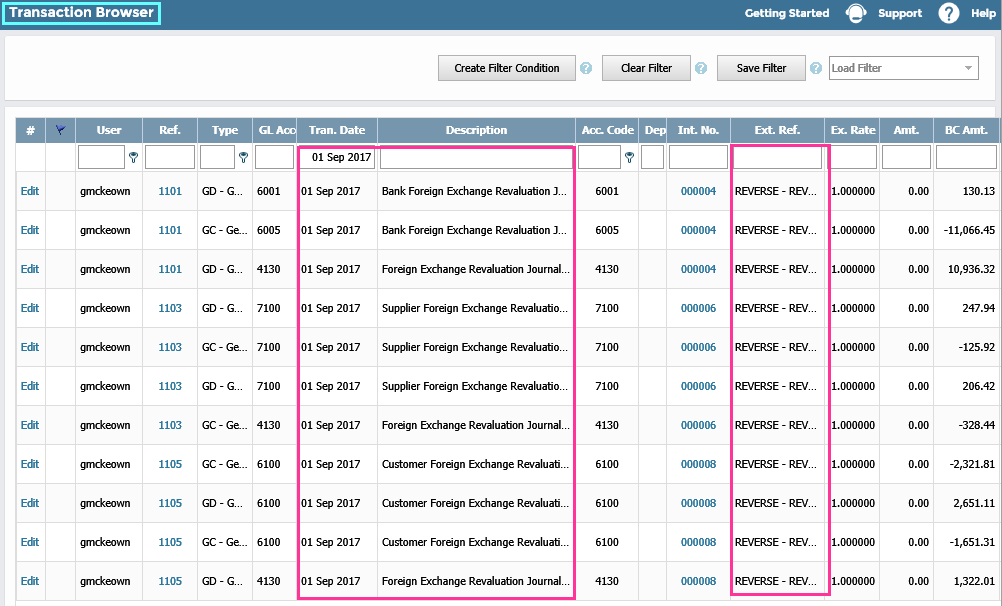

And here are the Reversals;

And here are the Reversals;

4. Aged Balance Reports:

The Supplier (Vendor) and Customer Aged Balance Reports contain an extra line in order to reconcile with the General Ledger Control Accounts. Here's a copy of the Creditor's (AP) Aged Balance Report;

And the Purchase Ledger (AP) Control Account Postings;