Introduction

This guide explains how to submit already prepared Group VAT Returns to HMRC via MTD. Irish companies can create a Group VAT Return in the same way, without submitting it to HMRC.

Prerequisite: Set up your group for submitting Group VAT via MTD, following the steps outlined in Connecting to HMRC for Group VAT Returns (MTD).

For the purposes of this article, the following terminology will be used:

- Group VAT MTD Reporting Entity: This represents a central company that is registered for Group VAT. Note, it is not possible to use a consolidation entity for this purpose.

- VAT Group Entity: This represents all trading entities that are part of the VAT group.

Note: Feature Access

Please contact support@accountsiq.com if you cannot see the Group VAT Return option. This might require enabling the Group Accounting add-on.

See:

Create VAT returns in the VAT Group Entities

Return but do not submit VAT Returns in each of the VAT Group Entities, including the designated Group company if this company is a trading entity. See Submitting Entity VAT Returns (UK & Ireland) for more details.

Note the following:

- It is important that there are no active connections to HMRC MTD in the companies themselves. Remove any active connections from the VAT Group Entities if they exist.The returns will not be submitted from the group companies individually. Instead, they need to be totalled and submitted from the Group MTD Reporting company.

- Care should be taken to ensure that the Reconcile From and Reconcile To dates are aligned with the Group VAT period as they will not be pre-populated from a connection with HMRC.

- Post any adjustment journals in the VAT Group Entity before submitting the VAT (i.e., when the status is Saved, not Returned). They can then be included in the return.

Info: Non-Trading Entities and VAT Reporting

If you nominated a non-trading entity as your Group VAT Reporting entity, you have two options:

- Update your Group VAT Reporting Entity to a trading entity in your VAT Group, as you can now create Entity and Group VAT returns in the same entity.

- Continue to use the non-trading entity as your Group VAT Reporting entity. However, please note, that to submit the Group VAT Return you will have to create and return a "blank" Entity VAT Return for the period in the non-trading entity.

See:

Create a Group VAT Return

Step One: Create a VAT Return

In the Group VAT MTD Reporting Entity, go to GL > VAT Return Listing.

Previous VAT Returns will have one of the following statuses:

- In Progress: The Group VAT Return has been created but not submitted to HMRC. You can still edit and delete in-progress Group VAT Returns. Click on its reference if you need to make any edits.

- Submitted: If the Group MTD Reporting entity is connected to HMRC, then Group VAT Returns created in this entity can be submitted to HMRC. You cannot edit or delete submitted Group VAT Returns.

- Returned: If the Group MTD Reporting entity is NOT connected to HMRC, then Group VAT Returns created in this entity can be marked as Returned. You cannot edit or delete returned Group VAT Returns.

To start a new return, click Group Return to open a Group VAT Return Details form.

Complete or check the following:

-

VAT Return Reference: To save a Group Return, enter a unique VAT Return Reference.

- Returned From, Returned To: These dates will appear on VAT reports. If the entity is connected to HMRC these dates will be auto-populated based on the current HMRC Reporting dates for the company. Note, entity VAT amounts will only be aggregated if the Reconcile To and Reconcile Date in the Entity Return exactly match the Reconcile From and Reconcile To dates in the Group Return.

-

VAT Totals: This aggregates the totals of boxes 1,2, 4, 6,7,8,9 in each of the entity returns.

- VAT on Sales and Other Outputs: VAT due in the period on sales and other outputs.

- Vat on EU Acquisitions: VAT due in the period on acquisitions of goods made in Northern Ireland from EU Member States.

- Total VAT Due: The sum of Box 1 and Box 2.

- VAT on Purchases And Other Inputs: VAT reclaimed in the period on purchases and other inputs (including acquisitions from the EU).

- Net Value: Total VAT for payment or reclaim. The value in this field is the difference between the figures in boxes 3 and 4. If the figure in box 3 is more than the figure in box 4, then you must pay this amount. If the amount in box 3 is less than the figure in box 4 then you can reclaim this amount.

- Total Sales: Total value of sales and all other outputs excluding any VAT.

- Total Purchases: The total value of purchases and all other inputs excluding any VAT.

- Supply of Goods to the EU: Total value of all supplies of goods and related costs, excluding any VAT, to EU member states.

- Aquisition of Goods From EU: Total value of all acquisitions of goods and related costs, excluding any VAT, from EU member states.

-

Group Company Status: The Group Company Status listing displays the status of the VAT Return for the period in each of the entities in the Group. This can include the Group Entity itself. A Group Entity Return can have the following status:

- No Return found: This indicates a return has not been created in the entity for the VAT reporting period.

- In Progress: A VAT Return has been created and saved in the entity but has not yet been returned.

- Returned: A VAT Return has been created and returned in the entity. You cannot submit a Group VAT Return until all the Entity Returns have a status of Return. If they do not, make returns in each entity.

- Submitted

- VAT Reports: You can run the Group VAT report directly from the Group VAT Return. The report will be run automatically for the Reconcile From and Reconcile To dates of the period. The report shows the breakdown of the Group VAT by entity. The report cannot be run if the Group VAT Return has not yet been saved.

Step Two: Submit (UK) or Complete (IRE) a VAT Return

- Submit or complete the Group VAT Return:

- If the Group VAT entity is not connected to HMRC, you will not have the Submit option but can mark the Group Return as Completed. Returns with a Completed status can be re-done by admin users.

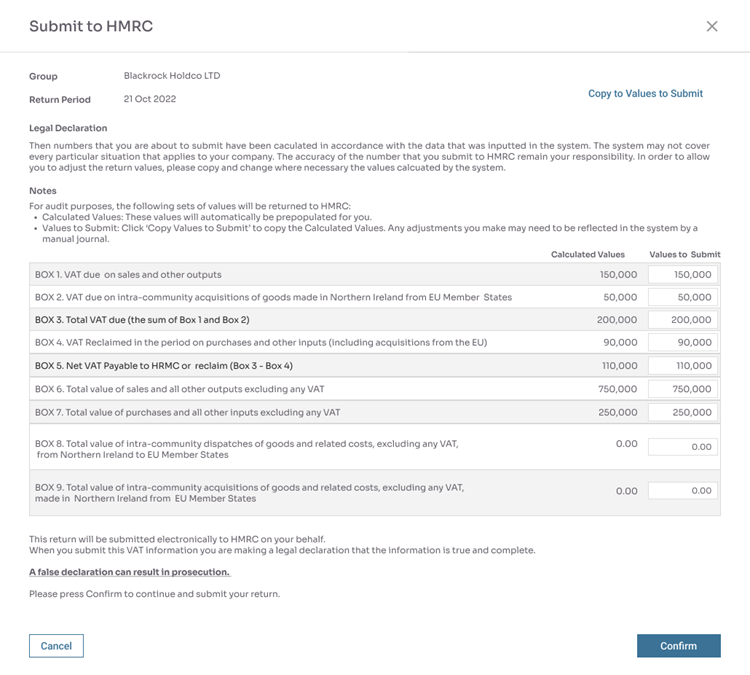

- If the Group VAT entity is connected to HMRC, click Submit to open the HMRC submission form.

- Check that the following values in the HMRC form are correct:

- Calculated Values: The fields are auto-populated as per the Group Return.

-

Values to Submit: The submitted values are auto-populated with the Calculated Values. However, you can still edit values, if required, before final submission to HMRC.

- Click Confirm to submit the VAT return with HMRC. You will receive a message confirming that the return was processed successfully by HMRC. The HMRC Submission form will close, and you will be returned to the Group VAT Return.

Note the following:- The statuses of all the Entity Returns in the Group will be updated to Submitted. You cannot edit or delete submitted Entity Returns.

- The status of the Group VAT return will be updated to Submitted. You cannot edit or delete submitted Group Returns.

- Copies of the Group VAT Return, HMRC Confirmation Message, and HMRC Submission form are automatically attached to the Group VAT Return. You can view these from the VAT Listing.

Group VAT (10.5) - AIQ Academy

Group VAT (10.5) - AIQ Academy