Introduction

Sales Journals are used to post adjustments to Customer Accounts where no VAT needs to be recorded:

- Sales Credit Journals: Decrease the amount due from a Customer by crediting the Customer Balance and Control Account, and debiting the selected GL Account.

- Sales Debit Journals: Increase the amount due from a Customer by debiting the customer balance and control account, and crediting the selected GL Account .

To create a Sales Journal, go to Sales > Customers. Under Actions, select either Create Sales Credit Journal or Create Sales Debit Journal.

Posting Sales Debit, or Sales Credit Journals

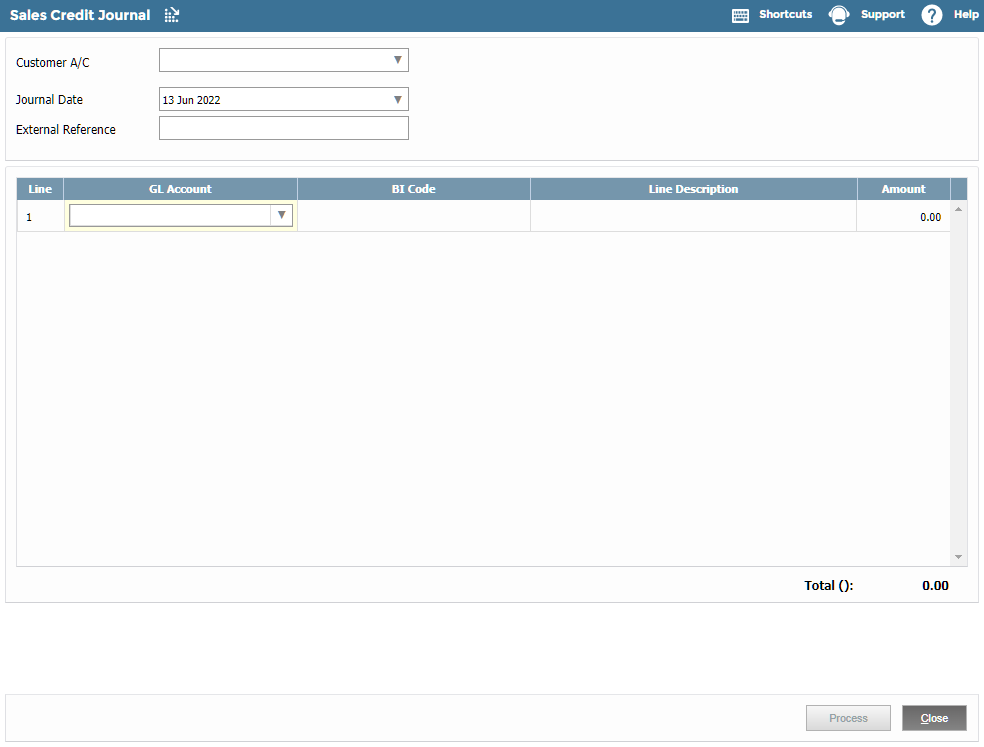

1. To create a Sales Debit, or Sales Credit Journal, in the refund screen complete the following:

- Customer A/C: Enter the customer name or account code.

- Exch. Rate: If a foreign currency customer is selected this will default to the latest exchange rate for their currency. This rate can be updated as required.

- Journal Date: This defaults to today's date and can be changed as required.

- External Reference: Enter a journal reference number if using.

- GL Account: Select the GL Account from the list. If you need to post an adjustment to a bank account, use the new refund screen.

- Description: Enter a Description for the journal.

- Amount: Enter the journal amount in the customer currency.

-

BI Code: If required, select a BI code.

Clicking Close will close the screen without posting any transaction.